Kuda bank app is an online banking platform that offers many features that any other physical bank will offer, these makes it attractive to many in Nigeria.

Kuda bank also comes with any other exciting features that make it attractive and could be an alternative to the traditional banking system in Nigeria. It is no doubt one of the best fintech companies in Nigeria.

The Kuda Bank app is an online-only means with which you don’t need to visit any physical banks in order to take care of any issues which may arise.

Also read on my Rebateshop8.com

This is because of the usual stress people go through when they visit banks, most of which have long queues, wastes time, and sometimes people are unable to accomplish their goals for visiting the bank in the first place.

In this article, we will explore everything about Kudi Bank, its features that makes it reliable, and a great alternative for traditional banking.

Table of Contents:

What Is Kuda Bank App?

Kuda is an e-banking that has no physical branch anywhere unlike Zenith bank, First bank, Fidelity bank etc. Kuda bank is on for smartphone users, which means that potential customers without one will not be able to bank with them.

The Kuda bank app is available on the different smartphone platforms available, including Android, iPhone, Linux, Windows etc.

The app is hassle-free and provides you banking services at your own comfort, either when at home, school, church, market, events; anywhere.

The Kuda Bank app can easily be used by anyone with a smartphone due to its user-friendly interface which helps for easy navigation and execution on the app. It is optimized for fast loading, and thus allows for faster transactions.

Kuda is a no-fee full-service bank, leveraging on the power of digital and technology. Design for your mobile phone and great at helping your budget, spend smartly, and save more. The mission is to build the best bank for all Africans on the planet.

Who Is The Founder and Co-Founder of Kuda Bank?

The CEO and Co-founder of the Kuda Bank are Babs Ogundeyi and Musty Mustapha.

Babs Ogundeyi had his tertiary education at Brunel University, London, and has used the majority of his career in working in the boundaries of financing in the private and public sectors in Nigeria.

The CEO was once employed at the PricewaterhouseCoopers advising banks, as well as functioning as a senior special adviser on Finance to the Federal Government of Nigeria.

Babs Ogundeyi helped in the making of the first classified car magazine in Nigeria called the Motor Trader Nigeria which was subsequently purchased by Financial Standard, A Nigerian newspaper firm.

How Does Kuda App works?

Though Kuda is never listed as one of the top 10 oldest banks in Nigeria, it is a digital bank in Nigeria that does everything any other traditional banks do, through its app.

They are even registered with a Microfinance bank license. This digital bank allows its users to check accounts without any charges as other traditional banks do, free debit card, free funds transfer to other banks in Nigeria, and also provides loan options to eligible customers.

These are exciting offers for potential customers due to the high fee which traditional banks charge its customers for some of their services like funds transfer to other banks, Atm card maintenance, debit card issuance, and so on.

Banking with Kuda app

It is important to understand that savings made with Kuda bank app does not just lie in the account unused but it is issued out on loan to borrowers with interest attached.

Your savings might also be invested in other businesses, and whatever proceeds from such investment belongs to the bank.

There is nothing to fear, as this is the same procedure that other traditional banks use to earn. The only difference is that traditional banks charge more, while Kuda bank charge considerably little or even nothing at all.

The yield of investment by this bank covers all the free transfer, debit cards, and other services offered by the bank.

Many people ask where the bank earns from. This is easy because the yield from the investments Kudi Bank makes is enough to run the bank since they don’t build physical branches around.

How do I get the Kuda Bank Loan?

There is no loan option available on the Kuda Bank loan platform yet, but it is expected that this feature will be included in the app in the nearest future, according to them.

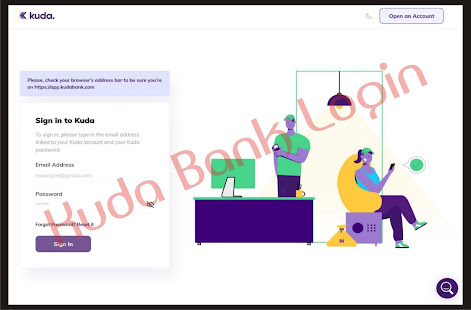

Kuda Bank Registration/Sign Up

Before you Open an account with Kuda Bank, you need a kuda bank app in Android phone, Iphone, Linux, windows etc.

Signing up and registering on the Kuda Bank app is quite easy, as long as you follow the steps with the correct details.

Once you have successfully downloaded the Kuda bank app from either app store as outlined earlier in this article, you can start by launching the app.

After launching the app, you get two options between signing up which is for new users while Log in is for established users.

Since you are a new user, click on the signing up option. The first of six pages will open up to you.

Here, you are required to input correctly your email, password, Re-enter password, as well as referral code. Referral code is a code you can use to register if someone already on the platform refers to you.

The benefits of this referral code will be discussed later in this article.

On the second page, you have to input your Last name, as well as your first name.

The next page requires you to input your date of birth and gender. On the third page, you are required to input your phone number.

You have to verify your phone number through the OTP which will be sent to the number provided. Next up is your street name, city, and state.

Also read on my Zetbull.com

On the final page, you just have to take a selfie, and there you have it; you just became a Kudi Bank user. It’s just as simple as that.

Kuda Bank App Account

Once you sign up, the next obvious thing you will do is open an account. You will be provided an account number which you can use to execute transactions.

On the Kuda Bank app, there are three types of accounts available for users. Each of these accounts has different attributes that make them unique.

Kuda Card delivery

There are three accounts in Kuda Bank App they are: Lite, Basic, and Premium.

Lite account: you only have to provide your name and phone number.

While on the Basic account: you need to provide your name, phone number, and BVN.

Premium account: Premium is the highest tier; you need a Name, phone number, BVN, and valid ID.

On the premium account, you can easily transfer 250k max at a go, with maximum transfers per day reaching 1 million naira while the value stands at 500,000 on a POS.

Kuda Referral Bonus and Codes

To get the Kuda Bank referral bonus, you must refer a newbie to open an account by downloading the app and signing up with your referral code.

Every account opened comes with a referral code which can be supplied to the newbie to fill in on the first page of registration. You get N200 for each person that you successfully refer to open a new account on Kuda Bank.

Conclusion of Kuda Bank App

The Kuda bank app, which is a digital bank, has come to stay.

This type of bank is able to function due to the advancements in technology and the transfer of the business to the digital space which seems quite accommodating for any size of business.

Although Kuda app still has a lot to do to convince people of the safety of their money, it is definitely worthwhile as well as a move in the right direction for the financial institutions in Nigeria.

Read on my Revsmedia.net

The fantastic features available for users are enough to entice anyone, especially when people hear about the prospect of running any kind of transaction for so little or free.

Thank you for reading my Kuda Bank App review If you have any question or comment, you can leave it below in the comment section below.